Monopoly Rule No. 8 – Once you own all the properties of the same colour you may develop them…

Board game rules apply in Sydney CBD – a benefit to the community chest?

My first few blogs should be approved by the end of the week but in the meantime, this is public knowledge and interesting.

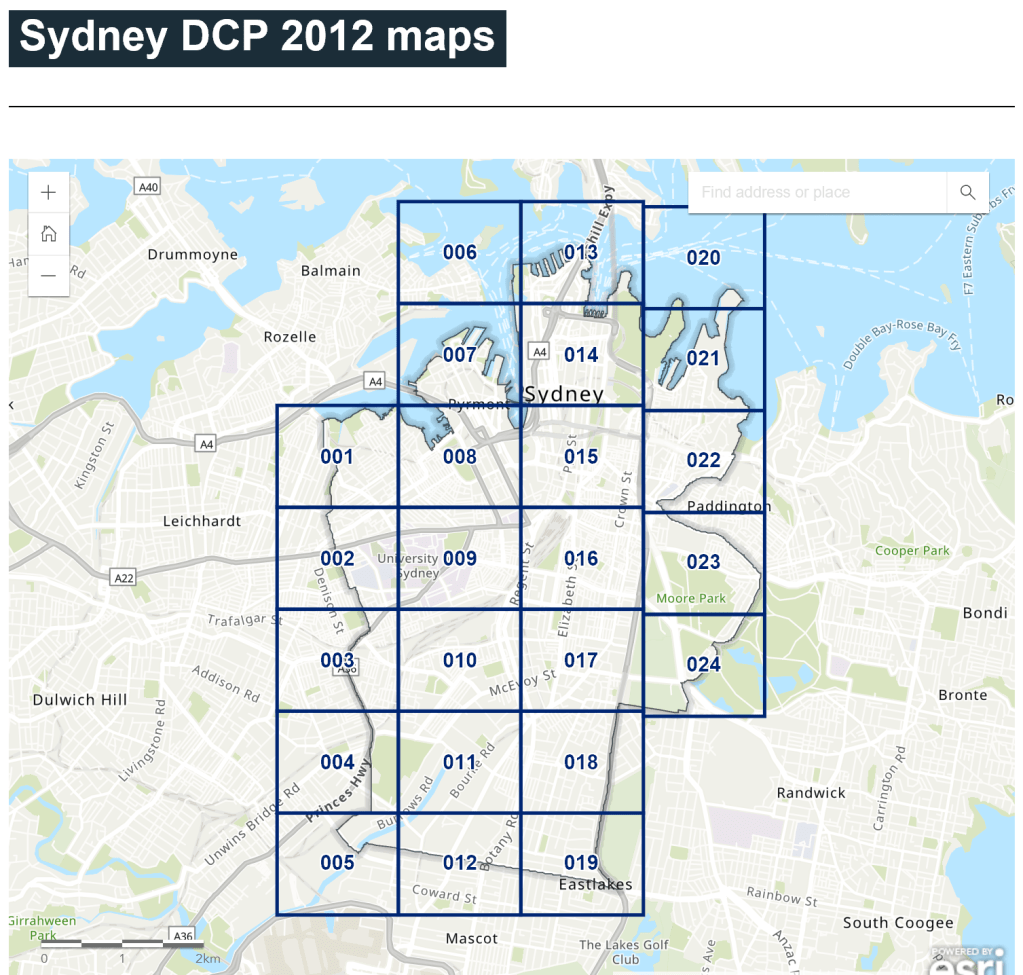

The City of Sydney or the Central Sydney Planning Committee is the consent authority for development other than major projects; there are currently 16 major projects (Figure 1), plus an additional 19 development control plans, dictated by area (Figure 2).

Now that you can picture the board. In square 014 is my current project, Sydney Metro Martin Place Station. Martin Place is a pedestrian mall in the middle of the CBD and has been described as the “civic heart” of the city as it is home to the Sydney General Post Office, the Seven Television Network News Centre, Cenotaph and the State Savings Bank building. As an iconic, cultural and historic area of the city planning permission is limited to 20 storeys. That is, unless, you own all the properties on the block. In which case the permitted number of storeys (and thus sqm of new office space) can be spread amongst the properties on the block.

Fig 3. Satellite image of Martin Place and the heritage bank.

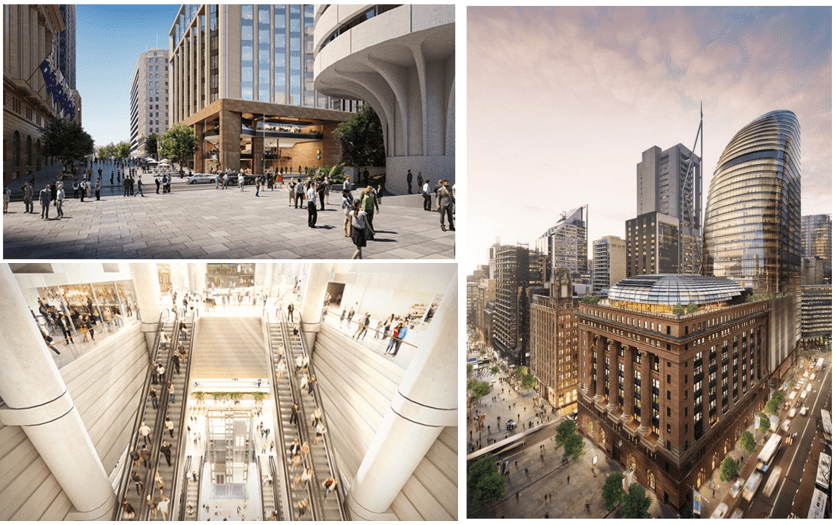

Macquarie Group is a financial services provider who own the heritage listed State Savings Bank building at the Centre of Martin Place. The new metro station tunnels beneath the bank and the station entrances are currently being excavated to the North and South (Figure 3). Work on site began in January 2018. By March that year Macquarie Group submitted an unsolicited proposal to the Government of New South Wales for two Over Station Developments (OSD). The towers would be predominately commercial, with Macquarie Group occupying both. The concept for the north tower was more than 40-storeys with a podium to be integrated with the existing 50 Martin Place (bank), while the south tower was to be more than 28 storeys.

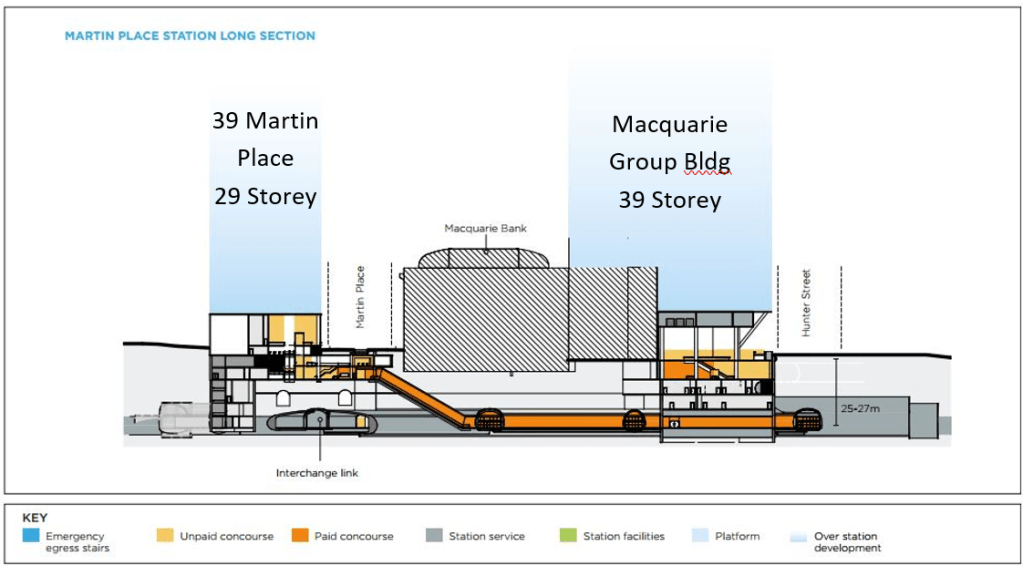

In May 2018, a site-specific amendment was made to the Sydney Local Environment Plan. The new planning provisions for the Martin Place Metro Precinct permitted a larger building envelope for the South site. The State Savings Building is only 10 storeys high yet by planning controls it could be 20. Thus, by owning all the properties on the block Macquarie Group were able to exploit a loophole and by September an agreement had been made for Macquarie to deliver the new station and two new towers by 2024, along with construction partner Lendlease. The North tower will be 39 storeys and the South will stand at 29 storeys. Transferring their available storeys (houses or hotels!) to a neighbouring property (Figure 4).

Community Chest gained $355 million as the Government sold the air rights above the new metro station. Macquarie will spend a further $637 million on the construction and delivery of the new underground Martin Place station integrated with a retail and recreational precinct, two new office towers and the existing Martin Place railway station.

Cost of the new station $378.6 million

Fee paid by Macquarie $355 million

Cost to the Taxpayer $23 million

Once the new buildings are complete in 2024, Macquarie is also likely to make another payment to the government to reflect the increased value of the land; as the world’s largest infrastructure asset manager, they should know. Macquarie now own the rights to one of the most coveted corporate addresses in Sydney. New metro trains are due to deliver thousands of customers from the suburbs straight to their new towers every four minutes. By 2056, New South Wales will have more than 12 million residents and Sydney is predicted to become a global city, similar in size to London or New York. Time will tell whether Macquarie’s investment will pay dividends, but I have a feeling owning the site of Sydney’s largest public transport hub will mean that the bank inevitably wins.

Its a fascinating site. Rob Thackwray was involved in the load take downs for the North tower as you will see from previous blogs. I look forward to seeing photos from site as this develops.