Archive

Using polystyrene as a structural filler replacement

Recently I’ve finished the installation of a welfare facility for a package of works I’m currently managing. One of the few outstanding tasks was to pour a very simple 100mm concrete footpath with a bit of of A193 mesh in the middle for cracking protection. The footpath was to surround the perimeter of the welfare facility.

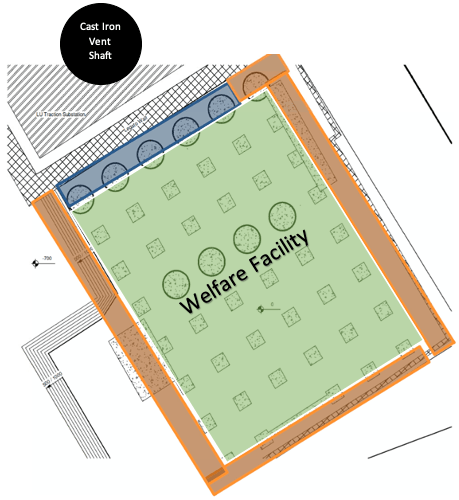

However shortly after installation, the temporary works team contacted me to say that their calculations for the welfare platform had been Category 3 checked (the highest level of check, conducted when there is a high risk to a third-party asset) and had failed. It failed on the basis that the crush (6F2) platform on which the footpath was going to sit was exerting too much pressure on the adjacent cast iron Victorian London Underground vent shaft and could lead to a catastrophic failure. Consequently the temp works team said that the platform needed lowering along one side of the welfare facility (see diagram below – area to be lowered in blue.).

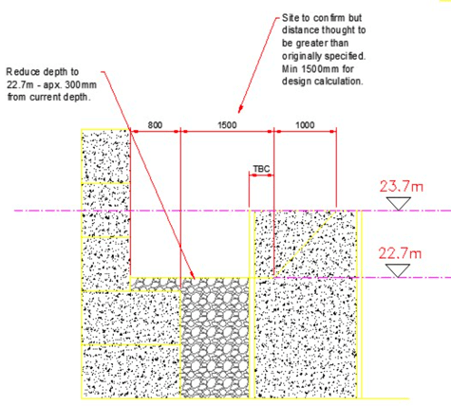

The platform needed lowering by about 1m over a 20m length to reduce the loading on the vent shaft – by removing 20m3 of 6F2 crush we would be able to reduce the loading on that area by about 48 tonnes. The sketch below shows the requirement to lower the platform from 23.700m to 22.700m.

The photos below show the reduction of the welfare platform level.

Back to the footpath. I now had to install a footpath over a perimiter that over a 20m length had dropped by 1m. We considered 3 options:

- Build the platform back up to 23.700m with a scaffolding solution (not permanent enough and would be a burden for the weekly temp works checks).

- Drop the footpath down to 22.700m with either a concrete or Haki staircase (not DDA compliant and restricts maintenance to this north west side of the welfare facility).

- Build up the platform to 23.700m with a light weight material. (this is the option we selected).

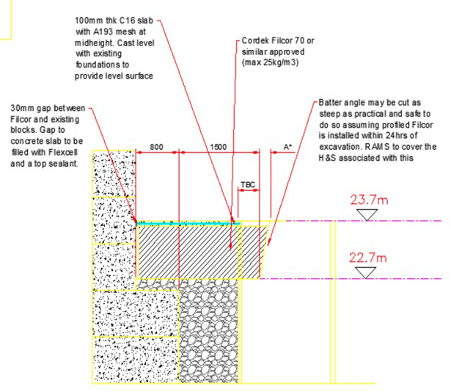

The foreman mentioned that he’d seen polystyrene being used before as a lightweight filler and although no one else in my team had any experience with it, it was proposed as a solution to temporary works who signed off the design (see below).

Filcor 70 is an expanded polystyrene with a density of 25kg/m3 and a compressive strength of 70kPa – plenty enough for us (although Filcor’s products go up to 190kPa, see link: https://cordek.com/products/filcor).

The photos below show the installation of the polystyrene followed by the concreting and finished footpath. I hadn’t heard of using polystyrene as a lightweight structural alternative so it might help people solve similar issues in the future – one to bear in mind.

Compensation Events for a change to British Standards?

BLUF: We have been working to one standard, the standard has been superseded, and now we’re being asked to work to the new standard… Without a compensation event.

Question: The following 3 paragraphs have been ripped from a TMR I’m currently writing (so excuse the lack of colour) but led me to wonder if anyone else had come across similar instances. For example when BS 7671 (requirements for electrical installations) moved from 17th to 18th edition in 2019, would you expect to be given a PMI and CE to compensate the possible increase to the cost of your works?

The Issue:

To understand CSJV’s BIM strategy, the author sought to identify the specific BIM related clauses in their contract with the Client. However, in an interview with Matthew, CSJV’s BIM Manager (2020), it was explained that a BIM level was not specified in the contract, in fact only the requirement to work to PAS 1192-2:2013 (British Standards Institute, 2013) was specified. PAS 1192-2:2013 focuses on the construction phase and specifies the requirements for Level 2 maturity; sets out the framework, roles and responsibilities and expands the scope of the Common Data Environment (CDE). When questioned on the lack of specifics in the contract, Matthew quoted guidance issued by the UK BIM Alliance, the UK’s largest community lead institution for BIM.

The UK BIM Alliance, and specifically its legal community, recommend that BIM levels are not specified in contracts. This is because, according to Matthew, that it would require the contractor to take too much risk. The perceived risk reflects the idea that it would be impossible for the Client to effectively define the BIM requirements of level 2 as they are too many in number, and simultaneously too complex and too vague. It is also relevant to mention that whilst more recent revisions to the PAS have reduced ambiguity, at the inception of HS2 Ltd. the standards were in their infancy.

The standards of BIM expected to be met by CSJV have become more ambiguous since the Client has recently been requesting elements of the BEP (BIM Execution Plan) to be delivered to ISO19650, a new standard superseding PAS 1992-2. CSJV claim that this would require a Project Manager’s Instruction (PMI) and an expensive Compensation Event (CE) as it is a change to the scope and would require a change to internal process. The Client claims that by requiring the latest standard at the time of contract signing, there was an implication that the latest standard would always be required – this has not yet been resolved but Matthew explained that without a PMI and CE they continue to work to the older PAS 1192-2.

The cost of Covid19 to HS2 – £1 Million a day

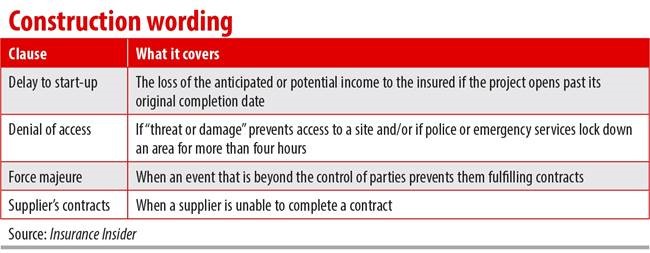

A friend of mine who works in insurance sent me the article below which I thought was interesting. It talks about the industry’s concerns about which clauses an insured might make a claim under due to Covid-19. It sounds like construction companies will have to pay extra for ‘disease extensions’ for policies in the future.

Has anyone had any insight yet as to what insurance companies are saying to your construction companies? With HS2 so large we’re looking at delay costs of around £1Million a day, the piling on my site is £30k a day alone and the insurance picture is unclear.

The Article

Vague construction wording could give rise to Covid-19 claims

The construction market is bracing for debate around Covid-19 claims as several wordings could be used by insureds to make a claim, Insurance Insider understands.

London-based sources told this publication that there will inevitably be delays to projects currently underway – with some sources giving estimates of six months or more – meaning policies would have to be extended. New projects that were due to start have now been left in limbo due to the coronavirus crisis.

While it is too early for loss notifications, construction underwriters are scrutinising wordings which could leave them open to potential losses that would threaten the class’ recovering profitability.

“We are in totally uncharted territory. We are in survival mode, we have to just get through the next two to three months,” one source said.

Rates in the construction market had been going up by 20-35 percent following high loss activity and a number of exits over the past 18 months including Beazley, Brit, CNA Hardy and Talbot, with a range of others passing through remediation exercises.

Delay to start up

One area currently under the microscope is a delay-to-start-up (DSU) clause, which is designed to cover the loss of the anticipated or potential income to the insured if the project opens past its original completion date.

However, sources told this publication that this clause’s trigger is typically physical loss or damage, and that it was not typical to have an infectious disease trigger, however the peril could be sub-limited.

One source added that, in the UK, infectious disease was a “standard or common” extension, so the UK may be disproportionately impacted.

Sources added that insureds typically have to wait until the scheduled completion date to make a claim, meaning there could be a time lag for claims.

Insureds can only claim under this DSU clause once, meaning they would have to buy this cover again – and possibly at an increased price.

Denial of access and force majeure

An additional area of concern is ingress or egress clause, otherwise known as denial of access. This wording could possibly warrant a payout, with one version of the clause implying that an insured could make a claim if there is a shutdown due to “threat or damage”.

Another version states that if emergency services or police have prevented access for more than four hours to a site, that could trigger a claim, even though it “wasn’t designed for this”, one source noted.

Force majeure wordings are also being examined by underwriters – where an event that is beyond the control of parties prevents them from fulfilling their contractual obligations.

Sources told this publication that, typically, force majeure events are specified in the construction contract, but some said coronavirus could be classed as a force majeure event, therefore making insurers liable.

There are various ways to invoke force majeure clause: a government mandate to cease construction, or prove that the coronavirus outbreak had caused one of the events on the list such as travel bans. The party would have to show that the events have impacted its ability to fulfil its obligations.

It was suggested that projects which relied on global supply chains were also struggling. This instance could be covered under all-risk or specific peril cover via suppliers’ contracts, but it is typically difficult to claim under, sources said.

Insurer actions

To combat uncertainty, insurers are introducing clarifications and exclusions on new business, but this is not universal across the sector.

“Some insurers are being slower than others to introduce the exclusions on new business. We are not looking to change existing contracts because that would be suicide; it would be stupid to go down that road. We are just looking at taking out disease extensions or making it clearer,” one source explained.

Overall, sources said the insurance sector was going through a “great period of uncertainty” and the picture globally was mixed, with some sectors stopping construction completely whereas others like the UK are allowing construction to go ahead.

Sources noted that risks were still getting bound and prices have gone up month on month for the past 12 to 18 months. This is set to continue, they added, and suggested it would be sensible for insureds to secure cover now before a potential price jump after the crisis.

There are still fears over the pipeline of new business as project financing is withdrawn by banks and lending is put on hold.

However, some underwriters were optimistic about stimulus packages, such as Donald Trump’s $2.2tn stimulus bill that was signed on Saturday, which could create jobs via new projects or infrastructure upgrades.